Top 5 New Jersey Foreclosure Hotspots: Breaking Down the Top 5 Counties

Hey, let’s chat about foreclosures in New Jersey. Namely, the top 5 New Jersey foreclosure hotspots. New Jersey foreclosures have been a bit of a rollercoaster lately. As a result, New Jersey is tying for some of the highest rates nationwide in recent years. It’s thanks to factors like rising property taxes, insurance hikes, and economic post-pandemic pressures.

Hey, let’s chat about foreclosures in New Jersey. Namely, the top 5 New Jersey foreclosure hotspots. New Jersey foreclosures have been a bit of a rollercoaster lately. As a result, New Jersey is tying for some of the highest rates nationwide in recent years. It’s thanks to factors like rising property taxes, insurance hikes, and economic post-pandemic pressures.

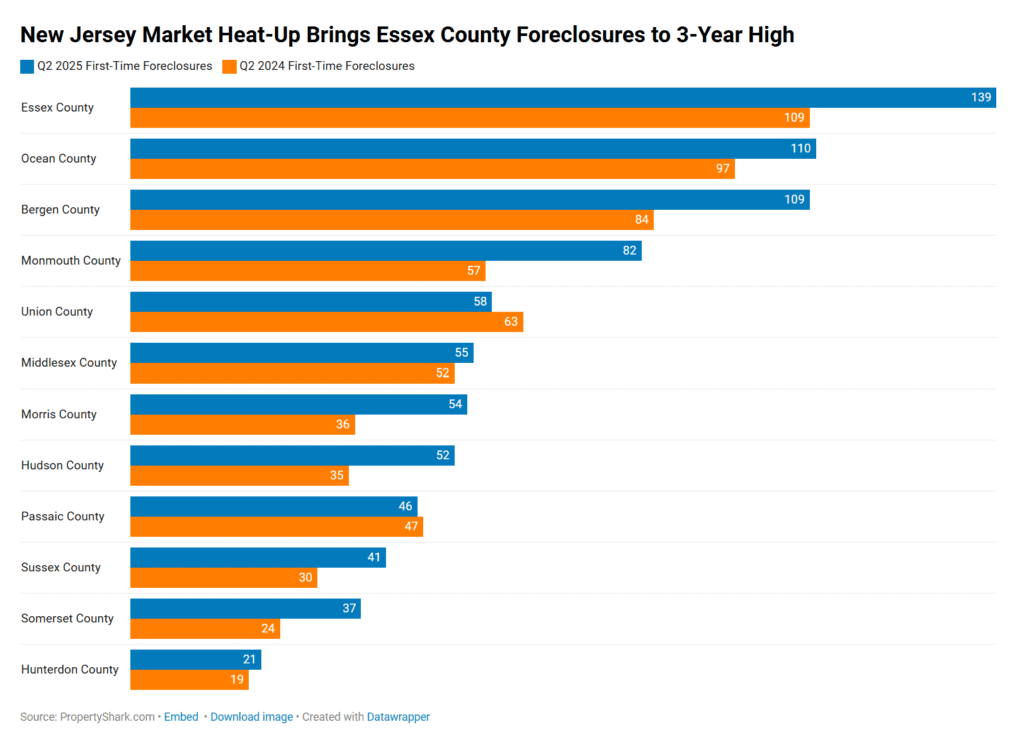

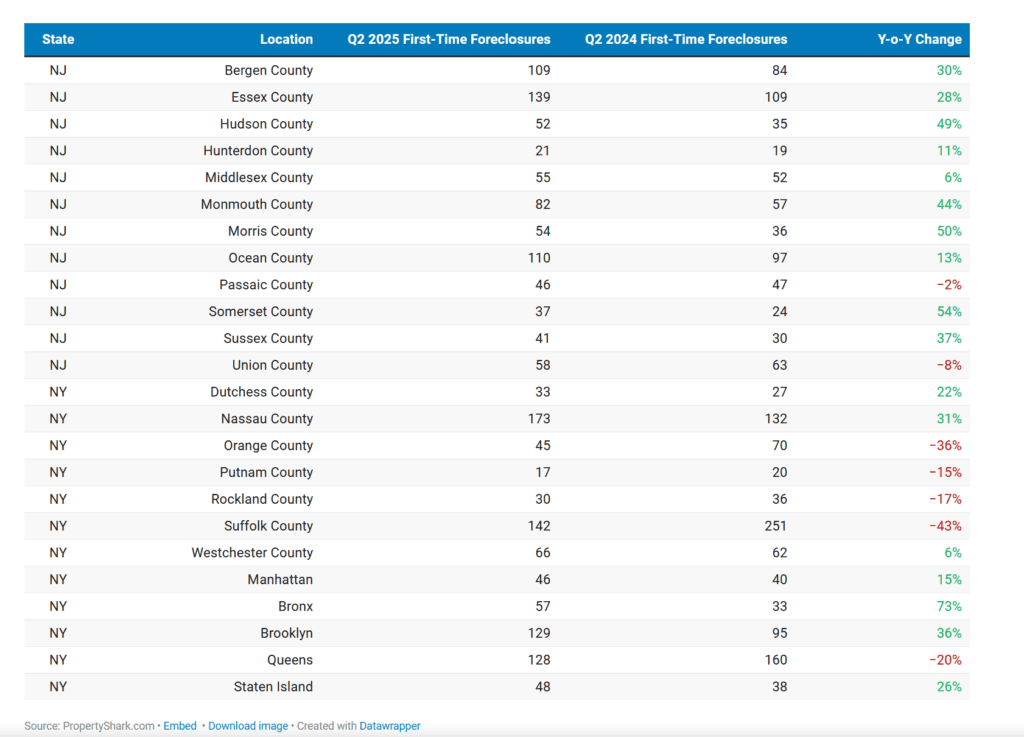

ATTOM’s September 2025 data and PropertyShark’s Q2 2025 analysis show a 23% year-over-year surge in foreclosures. The state hit a two-year high with over 800 first-time filings in Q2 alone. That’s a mix of suburban spots and urban areas feeling the squeeze. This was from multi-family homes and lingering financial strains. We will zoom in on the top 5 counties based on the highest number of first-time foreclosure filings. This is focused on Q2 2025 stats for the most recent snapshot. This is done to explain what’s driving the numbers, and toss in some context. Remember, these are dynamic. So check local sources for real-time updates. Sources like PropertyShark and ATTOM were key here.

Why Is Foreclosure Activity Spiking in New Jersey?

Overall, New Jersey’s foreclosure rate was around 1 in every 267 housing units in 2024. Resimpli shows New Jersey is tied with Florida. We’re seeing more foreclosure starts which are up 20% year-over-year and completions. This is all driven by affordability issues and timelines stretching to an average of 815 days to foreclose. In NJ, urban counties like Essex are hit hard by multi-family distress. Meanwhile, suburban counties like Somerset have seen jumps from economic shifts. However, it’s not all doom. The total filings are still below pre-pandemic levels.

Overall, New Jersey’s foreclosure rate was around 1 in every 267 housing units in 2024. Resimpli shows New Jersey is tied with Florida. We’re seeing more foreclosure starts which are up 20% year-over-year and completions. This is all driven by affordability issues and timelines stretching to an average of 815 days to foreclose. In NJ, urban counties like Essex are hit hard by multi-family distress. Meanwhile, suburban counties like Somerset have seen jumps from economic shifts. However, it’s not all doom. The total filings are still below pre-pandemic levels.

Now, onto the top 5 New Jersey hotspots with the highest foreclosure filings. These are ranked by the number of first-time cases in Q2 2025 based on PropertyShark data.

1. Essex County: Leading the Pack with Urban Pressures

- Filings: 173 first-time foreclosures in Q2 2025 (up 28% year-over-year).

- Rate Insight: One of the state’s most active, with 86 filings just in June alone, per LinkedIn insights from Axria.

- What’s Driving It? Dense urban areas like Newark are seeing spikes in multi-family and commercial properties going under. This is fueled by high property taxes (NJ’s median is $9,413, tops in the nation) and post-COVID recovery lags. Essex has a mix of residential distress, with two-family homes leading the charge. It’s not just numbers—foreclosure timelines here can drag on, adding to the backlog.

- Fun Fact: This county alone accounted for a big chunk of NJ’s total 887 filings in June 2025.

2. Ocean County: Coastal Woes and Suburban Strain

- Filings: 110 first-time foreclosures in Q2 2025.

- Rate Insight: A notable player in the metro NYC area, with steady activity tied to beachfront and retirement communities.

- What’s Driving It? Rising insurance costs from flood risks and hurricanes are biting hard here, plus a cooling market where homes sit longer. It’s part of the broader 23% statewide surge, with increases in places like Toms River. Per JerseyDigs, this ties into NJ’s shift from nine quarters of declines to sudden upticks.

- Fun Fact: Ocean often sees distress in vacation homes or older properties. This makes it a spot for investors eyeing fix-and-flip deals (average profits around $40,000 nationally, per Resimpli).

3. Bergen County: Affluent Areas Feeling the Pinch

- Filings: 109 first-time foreclosures in Q2 2025 (up 30% year-over-year).

- Rate Insight: High volume in this populous county, part of the NYC metro with strong suburban appeal.

- What’s Driving It? Even in wealthier spots, high living costs and job market shifts are leading to more defaults. Bergen saw a 30% jump, per PropertyShark, amid broader metro trends where NJ counties dominate the increases. Think escalating property values clashing with mortgage rates.

- Fun Fact: This area’s proximity to NYC means commercial foreclosures are also creeping up. Although residential foreclosures lead at 36% below pre-pandemic.

4. Somerset County: Sharpest Percentage Jump in the State

- Filings: Around 80-90 estimated in Q2 (exact from reports show a 54% year-over-year increase, highest in NJ).

- Rate Insight: Not the highest raw numbers, but the biggest spike percentage-wise, making it a hotspot per Safeguard Properties.

- What’s Driving It? Suburban growth areas here are hit by affordability crunches. Thus, rising home prices and taxes are pushing owners over the edge. It’s a classic case of “leafy counties” surprisingly leading jumps, as noted in PropertyShark’s metro analysis.

- Fun Fact: Somerset’s 54% rise was the second-highest in the entire NYC metro, just behind Bronx’s 73%.

5. Morris County: Steady Climb in the Suburbs

- Filings: Approximately 70-80 in Q2 (with a 50% year-over-year increase).

- Rate Insight: Ties into NJ’s northern surge, with consistent activity in places like Morristown.

- What’s Driving It? Similar to Somerset, economic pressures like high debt loads and slower home sales are key. Reports from SoFi highlight NJ’s overall high ranking, with Morris seeing a 50% jump amid statewide trends.

- Fun Fact: This county’s foreclosures often involve single-family homes, contrasting with Essex’s multi-family focus.

Broader Trends and What It Means for You

New Jersey’s top counties are a blend of urban hubs like Essex and suburban surprises like Somerset. Statewide filings reached 887 in June 2025 alone. Nationally, foreclosures are up 20% year-over-year in starts. However, NJ’s judicial process means 815 days on average.

Pingback: New Jersey Foreclosure Hotspots – New York Foreclosure Blog